The total private sector credit issued by Nigeria’s commercial banks increased, from 11.4trn in Q1 2016 to 13.8trn in Q3 2016 according to the National Bureau of Statistics.

The provision of credit stimulates and accounts for a statistically significant variation in economic growth in Nigeria due to the underdeveloped capital markets.

As such the increase in credit does not correlate with the three consecutive quarters of contraction that has placed the Nigerian economy in a recession. This year’s recession is the first in over a decade.

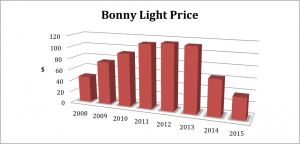

The recession is primarily driven by the decline in oil revenue received by the government due to declines in global oil prices and reduction in oil production caused by militancy activities in the Niger Delta region.

Further analysis show the percentage of total credit to the oil and gas industry has increased from 16.94% in Q1 2016 to 22.53% in Q3 2016 by NGN 1.4trn. Loans to the oil and gas sector contributed significantly to the rise in NPLs to 11.7% at Q2 2016 and may explain why the increased provision of credit is not stimulating the economy.

Whilst during the same period the percentage of total credit to the manufacturing industry has decreased from 14.10% to 12.16%, although the absolute credit to the sector increased by NGN 0.3trn.

Simply increasing access to credit won’t generate growth in the economy, Government must enact policy to incentivize access to credit to sectors such as the manufacturing industry that will improve the balance of trade, thereby strengthening the Naira and reducing the inflation rate.

Credit guarantee schemes where the CBN provides proportional guarantees to banks should a creditor default on their loan and/or special low interest rates will help to diversify the provision of credit, the economy and promote sustainable growth.

Comments are closed.