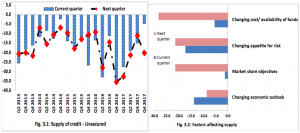

There is good news for Nigerian borrowers today, as the CBN released data which shows the availability of unsecured loans provided by Nigerian banks to households rose and was expected to rise further. Lenders such as GTB, Access and Zenith reported higher appetite for risk and brighter economic outlook as the major factors that contributed to the increase in loans in Q4 2017.

Despite lenders’ resolve to tighten the credit scoring criteria for total unsecured loan applications in the review quarter, the proportion of approved total loan applications for households increased. Lenders expect to still loosen the credit scoring criteria in the next quarter, but anticipated that the total loans applications to be approved in Q1 2018 will rather decrease.

The proportion of approved credit card loans increased in Q4 2017 despite the lenders’ stance on the credit scoring criteria for granting credit card loans. However, the proportion of approved overdraft/personal loans applications decreased.

Interest rates on non-collateral overdrafts, credit cards and personal loans on approved new loan applications reduced in the current quarter and was expected to further narrow in the next quarter. Overall interest rates on unsecured lending reduced in the current quarter, and was expected to reduce in the next quarter.

The CBN also stated Lenders experienced higher default rates on credit card and overdrafts/personal lending to households in the current quarter. They however, expect improvement in default rates in the next quarter. Losses given default on total unsecured loans to households worsened in Q4 2017 but were expected to improve in the next quarter. The expected improvements in the next quarter are driven by forecast positive economic conditions.

The StartCredits advice to Nigerians would be to shop around for the best rates using the loan search and make sure the application form is filled accurately to avoid any delays or rejections.

Comments are closed.