Saving money in Nigeria isn’t a matter of arithmetic- it is a matter of priorities. We often tell ourselves we’ll start saving once we reach a certain milestone, like when we... read more →

According to the CBN Weighted Average Interest Rates charged by banks in the first half of 2017 was 23.79%. The banking sector provided a total credit of N63.27tn to finance... read more →

Choosing the right loan in Nigeria is a very difficult decision to make given the plethora of options increasingly available. We now have many registered moneylenders who provide loans instantly... read more →

Nigeria’s journey with foreign debt became noteworthy in the 1950s when the Nationalist wave swept through Africa to spark the independence of Nations from their colonial masters. A World Bank... read more →

Nigeria’s rising public debt over the last few quarters has increased pressures on government expenditure to cover interest repayments. Although a comparative analysis shows that the ratio of debt-to-GDP is... read more →

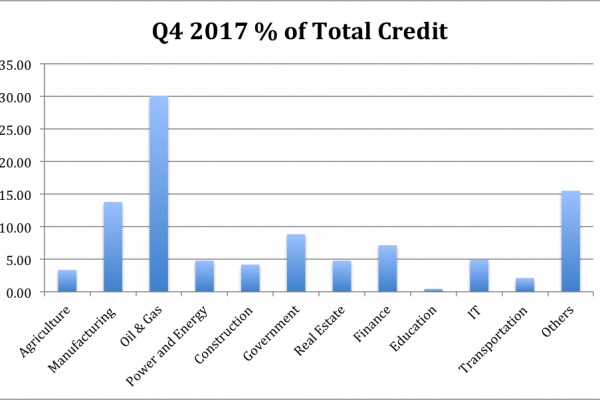

Who is receiving Nigerian bank loans is a question we have been asking ourselves for a long time, at work, church and family gatherings. The banking sector provided a total... read more →

Bitcoin in Nigeria Our nation is currently trading about $4.7 million Bitcoin in Nigeria a week, up from about $300,000 per week a year ago. That’s No. 23 globally, according to... read more →