Nigeria’s rising public debt over the last few quarters has increased pressures on government expenditure to cover interest repayments. Although a comparative analysis shows that the ratio of debt-to-GDP is very low in Nigeria.

Nigeria has a debt to GDP ratio of 21.19% as at December 2017. Nigeria has a total outstanding debt of 20trillion naira as at Q3 2017 up from 17trillion in 2016. The debt to GDP ratio is far below the critical limit of 40% the FGN has set for the Nigerian economy.

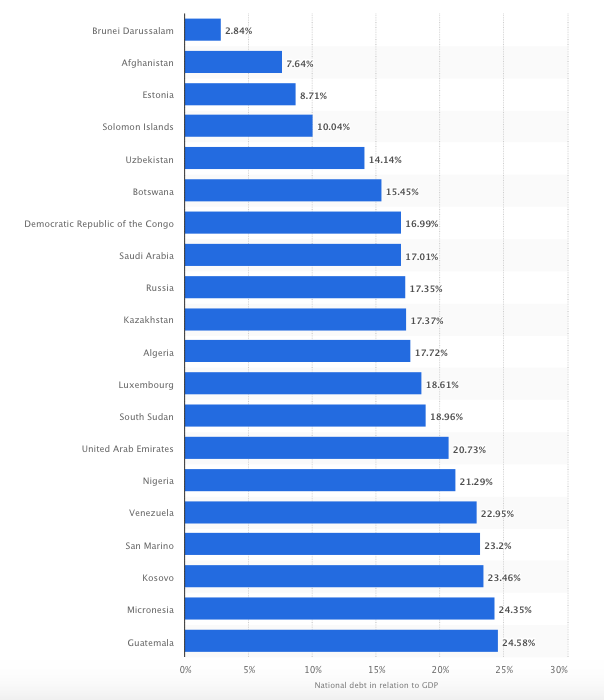

Nigeria is among the 20 countries with the lowest National Debt in relation to the Gross Domestic Product, GDP according to a report by Statistia. In 2017 Nigeria’s estimated level of national debt reached about 21.19% up from 2016 at 14.69% of the GDP, ranking 14th up from 9th in 2016 of the countries with the lowest national debt.

The statistic shows the 20 countries with the lowest national debt in 2017 in relation to the gross domestic product (GDP). The data refer to the debts of the entire state, including the central government, the provinces, municipalities, local authorities and social insurance. In 2017, Russia’s estimated level of national debt reached about 17.35 percent of the GDP, ranking 9th of the countries with the lowest national debt.

The debt-to-GDP ratio is an indicator of a country’s ability to produce and sell goods in order to pay back any present debts, however these countries should not retain newer debts in the process. Many economists believe that if a country is able to produce more without impairing its own economical growth, it can be considered more stable, particularly for the future. However, the listed countries, with the exception of Russia and Saudi Arabia, are not necessarily economic first-world powers. Additionally, economically powerful countries such as the United States and France maintain one of the highest debt-to-GDP ratios, signifying that occurring debt does not necessarily damage the state of the economy and is sometimes necessary in order to help develop it.

Saudi Arabia has maintained one of the lowest debt-to-GDP ratios due to its high export rates, which primarily consist of petroleum and petroleum goods. Given the significance of oil in today’s world, Saudi Arabia produces enough oil and earns enough revenue to maintain a high GDP and additionally refrain from incurring debt.

Japan recorded the highest debt-to-GDP of 250.40%. This was followed by the USA with 104.17%; France 96%, United Kingdom (UK) 89.30%; and Germany 68.30%. India and China have a debt-to-GDP of 69.50% and 42.90% respectively.

The low debt-GDP level of Nigeria is most likely explained as a function of poor corporate governance in the government relative to other economies and can be seen as a discount rate on governance.

Comments are closed.